Yet another “ plus “ to retirement savings; this one aimed at low to moderate income singles and couples providing a tax “credit” for contributions to virtually any retirement plan. That’s right, single filers with an AGI (adjusted gross income) below $19,000 and couples (filing jointly) with an AGI under $38,000 can receive a credit of 50% of the contributions made to a traditional or Roth IRA, a 401k, 403b etc. Eligibility is simple: you must be over 18 yrs. old, not a full time student, not a dependant on someone else’s tax return, and have earned income. Furthermore, a 20% credit is available to singles up to $20,500; couples up to $41,000; and finally, a 10% credit to singles up to $31,500, and couples up to $63,000.

Search www.irs.gov/retirement then Savers Credit (general information).

SO, you ask, who might benefit from such a tax break? Perhaps that “budding” artist

or musician, waiters and waitresses, any part time worker, temp or entry level person. Many wage earners can be found in healthcare, teaching, daycare, and food service where many are paid hourly and compete for more hours.

Jane is a waitress with income of $19,500. A $500 contribution to a traditional IRA would reduce her AGI to $19,000, eligible for a 50% credit or $250.

Rob and Sally have a combined income of $39,300 (jointly). A $1,000 contribution to a traditional IRA would reduce their AGI to $38,300 (20% credit), however, make that contribution $1,300 ($300 more) they could enjoy a 50% credit or $650 vs.$200

Contributing to a retirement fund may seem like a “tall order” for some, however there are creative ways to bring that about. One strategy might be to borrow from a parent so as to fund an IRA, obtaining the credit and repaying the loan with the higher refund you’ll enjoy as a result of paying less tax (the credit): Michael’s parents have offered a different twist: they’ve decided to contribute the “rent” he pays to an IRA. That $100 monthly contributed ($1,200 annually) will result in a 50% credit (based on his final AGI) or $600. For those hesitant to “tie up” the money a Roth IRA is a great solution, though it won’t reduce your AGI, a credit still applies and any contribution is always available to withdraw without penalty, if needed

By far, however, is the benefit Diane will receive. She works at a large hospital as an aid and as such is eligible for the company 401k-retirement plan. The plan matches dollar for dollar contributions to the plan, up to 3% of participating employees’ earnings. With a salary of $21,000, she can contribute $630 to be matched (3%). Furthermore, it reduces her AGI to $20,370, eligible for 20% credit ($126).

To summarize:

$630–Diane

$630—Co. match

$126 – tax credit

Total — $1,386 — can we say, “bang for your buck”

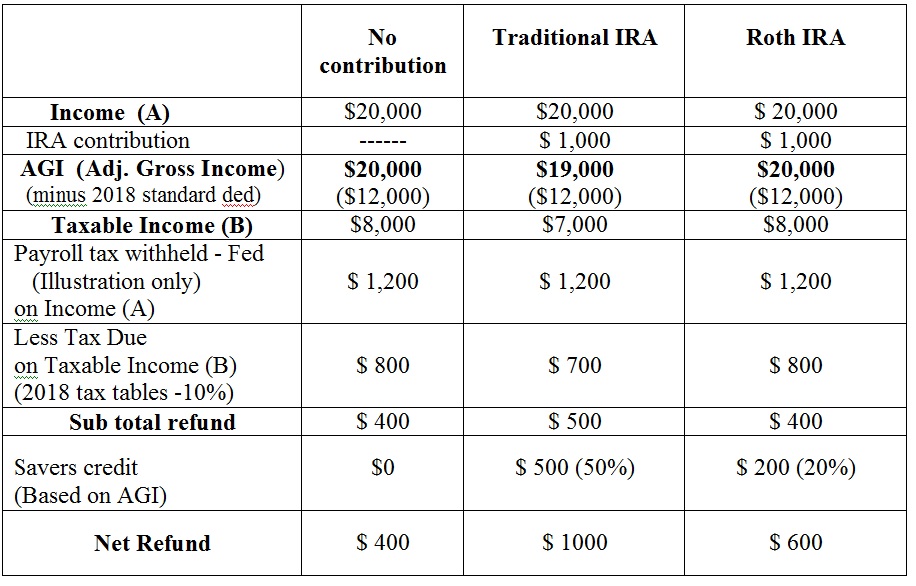

So, check this out: A single wage earner with an income of $20,000 choosing to or not to contribute to a retirement account:

It goes without saying that saving for retirement may be difficult especially with incomes in this range, however, now just may be the time, what with more take home pay as a result of the Tax Relief Act. Find a way to begin….you won’t be sorry! The benefits are worth the sacrifices.

Keep in mind; the credit is not necessarily a refund, but rather, a means of paying less tax. Remember, for most of us, having paid taxes all year long, paying less tax virtually results in a refund.

As always,

Cents Maker